An Eccentric Guide: U.S. Dollar Value Measured 3 Different Ways

Nov 24, 2023 By Triston Martin

Introduction

The economy's current status should be considered before making any decisions about the purchase or sale of dollars. Foreign investors will have a greater propensity to put their money into a country that has a robust economy since the return on investment (ROI) that they can anticipate is higher. Because investors are always looking for the highest yield that is also predictable and "safe," an increase in investment, especially from overseas, results in a complete capital account and a high demand for dollars. This is because investors are always looking for the highest yield that is also predictable and "safe." On the other hand, foreign money leaves the country due to consumer spending, which entails purchasing goods and services from other countries. This results in the outflow of foreign currency. We may have a current account deficit if our imports' value is higher than our exports.

A trade deficit can be reduced if a country has a healthy economy and can attract foreign investment. Even though it is a debtor nation that borrows this money to consume, the United States can continue to play its role as the consumption engine that fuels all economies around the world. Because of this, other countries can increase their economies by exporting to the United States. When deciding where to put their money, currency traders must consider all the elements that can affect the dollar's value before betting on a particular direction or trend.

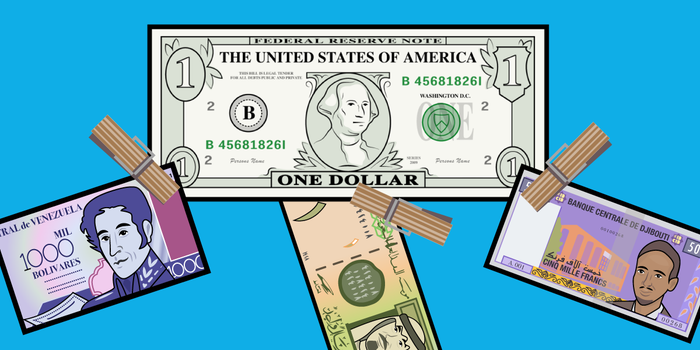

Three Measures of the Value of a Dollar in the United States

Supply vs Demand for Driving Dollar Value

The demand for the United States dollar rises due to the United States practice of requiring foreign buyers to settle payments in U.S. dollars for purchasing American-made goods and services exported to their countries. They will have to sell their native currency to get the necessary amount of U.S. dollars to complete the deal. This is because the required payment is in U.S. dollars.

Bonds issued by the government of the United States or by large American corporations to acquire cash and afterwards purchased by investors from outside the country will likewise need payments to be made in the currency of the United States, which is the dollar. These bonds are issued in the United States by the federal government or large corporations. This is also true for international investors who wish to purchase shares in American firms; before they can do so, they must first convert their native currency into dollars.

These instances demonstrate how the United States contributes to an increased demand for dollars, which in turn increases the demand placed on the dollar supply and boosts the dollar's value in comparison to the currencies being swapped to purchase dollars. In addition, the United States dollar is regarded as a haven when there is uncertainty in the economies of other countries. As a result, the demand for dollars can frequently continue even when there are fluctuations in the performance of the U.S. economy.

Psychological Impact Of Market Forces On The Value Of The Dollar

A sell-off might occur if, for instance, the economy of the United States were to deteriorate and consumer spending was to come to a halt due to greater unemployment. If an investor sells bonds or equities, they may choose to repatriate the proceeds to their home nations and reinvest them there in the respective currencies of those countries. It is detrimental to the dollar's value when investors from other countries choose to repurchase their currencies.

Aspects of Finance That Affect the Value of the Dollar

Traders are accountable for making predictions on whether or not the supply of dollars will be more than the demand for dollars. To assist us in this endeavour, we need to close check on any new developments that may affect the dollar's value. The government's responsibility in this situation is to publish various economic statistics, such as data on payroll and GDP, as well as other indications that may assist us in determining the state of the economy.

Conclusion

A trader may find it helpful to keep a watch on the Dollar Index chart, which provides an overview of how the dollar fares against the other currencies in the index, in addition to paying close attention to market sentiment and technical indicators like government data. By observing the trends on the chart and keeping an ear out for the essential fundamental elements that affect supply and demand, a trader can get a sense of the overall flow of money and gain insight into how to choose lucrative trading positions.